Page 18 - NC Triangle Vol 6 No 5

P. 18

TACKER LECARPENTIER | Settlement Planning

Structured Settlements for Taxable Damages Claims: What You and Your Clients Need to Know

Structured settlements have been extensively employed in physical injury and workers compensation claims for nearly 50 years. O en referred to as “quali ed structured settlements,” these spe- cialized annuity plans (1) o er guar- anteed future periodic payments, (2) are paid free of federal, state and local income taxes and (3) can be tailored in nearly in nite ways to dovetail with the claimant’s future medical and life care needs. Moreover, life contingent plans o er the added - and critical - bene t that a claimant “cannot out- live” the lifetime payments.

However, most attorneys are un- aware that “non-qualifed” structured settlement plans are also available for taxable damage claims, such as em- ployment claims, emotional distress (only) claims, slander/libel claims, punitive damages, business disputes, alimony/child support claims, legal malpractice, etc. Likewise, your at- torneys’ fees can o en be structured

especially in contingent fee cases. Non-quali ed structure plans, if properly set up before nal resolu- tion of a claim, also o er guaranteed payments, signi cant tax savings, and exibility in plan design.

But, too many attorneys simply do not know that their clients could save signi cant income taxes by structur- ing their recovery. In fact, fas a cash settlement. will nearly always result in the claimant paying far more in income taxes than with a structured settlement. It also does nothing to avoid the very real risk of premature dissipation of those settlement funds.

WHY IS THIS?

If the claimant takes a taxable set- tlement in cash, the total amount is deemed to be received in the year of settlement for income tax purposes. us, federal, state and local income taxes are due on 100% of the settle- ment in that same tax year. In larger settlements, the claimant will have even higher tax rates, as each level of

the income tax brackets are reached. And, in extremely large settlements, the claimant may be required to pay supplemental and Alternative Mini- mum Taxes (AMT).

O en, a claimant – and the claim- ant’s attorney – may both end up pay- ing close to 50% in federal and state income taxes, a not-insigni cant portion of their settlement. Of big- ger concern in these cases, the claim- ant has a real risk of loss of principal a er paying the taxes, due to market volatility, high investment fees, com- missions, etc.

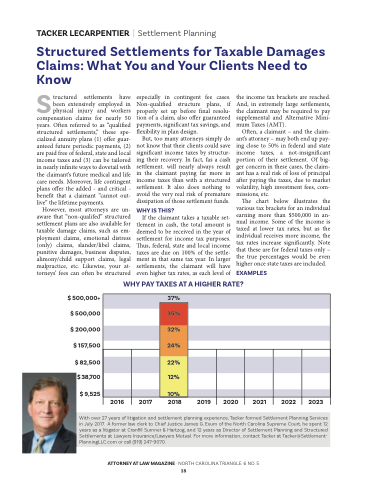

e chart below illustrates the various tax brackets for an individual earning more than $500,000 in an- nual income. Some of the income is taxed at lower tax rates, but as the individual receives more income, the tax rates increase signi cantly. Note that these are for federal taxes only – the true percentages would be even higher once state taxes are included.

EXAMPLES WHY PAY TAXES AT A HIGHER RATE?

37%

35%

32% 24%

22% 12%

10%

$ 500,000+ $ 500,000 $ 200,000

$ 157,500

$ 82,500 $ 38,700

$ 9,525

2016 2017

2018 2019

2020 2021

2022 2023

With over 27 years of litigation and settlement planning experience, Tacker formed Settlement Planning Services in July 2017. A former law clerk to Chief Justice James G. Exum of the North Carolina Supreme Court, he spent 12 years as a litigator at Cran ll Sumner & Hartzog, and 12 years as Director of Settlement Planning and Structured Settlements at Lawyers Insurance/Lawyers Mutual. For more information, contact Tacker at Tacker@Settlement- PlanningLLC.com or call (919) 247-9070.

ATTORNEY AT LAW MAGAZINE · NORTH CAROLINA TRIANGLE. 6 NO. 5 18